tax reduction strategies for high income earners australia

If you are an employee. August 12 2014.

Tax Planning Strategies For 2021 Tax Year With Mistakes To Avoid Financial Freedom Countdown

So the money was distributed to Mary.

. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

Current details of the governments three-stage Personal Income Tax Plan including changes to personal income tax thresholds and rates of tax that apply to them are summarised below. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. In many cases the tax savings can be tens.

Prepay tax-deductible expenses to bring your tax deduction forward. For example more income may be distributed to beneficiaries ion lower tax brackets or those with no other income to utilise their 18200 tax-free threshold and. A discretionary family trust can benefit high-income earners seeking to redistribute some of their income to family members in lower tax brackets.

Because of the way Australias income tax. Because of the way Australias income tax system is structured moving. Specifically important numbers for 2022 include.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Consider salary sacrificing to reduce.

Many Australian Tax Videos Are Discuss The Same BORING Strategies. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Investing in Early Stage Investment Companies.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. Tax reduction strategies for high-income earners in australia. The first way you can reduce your taxable.

Structuring your business and personal assets. Investing in lower income earning spouses name may be better. Delay receiving income to avoid paying tax in the current financial year.

The good news is that with a combination of tax deductions tax credits and contribution strategies you. Tax reduction strategies for high income earners australia. Private Health Insurance Tax Offset.

To encourage middle to high-income earners to reduce their dependability on the public health system and make the private healthcare. 15 Easy Ways to Reduce Your Taxable Income in Australia 1. As a general overview the most beneficial strategies for tax minimisation are.

For those trying to learn how to save tax in Australia salary sacrificing is one way. This rate is lower than the personal income tax rate. Because she stays at home she.

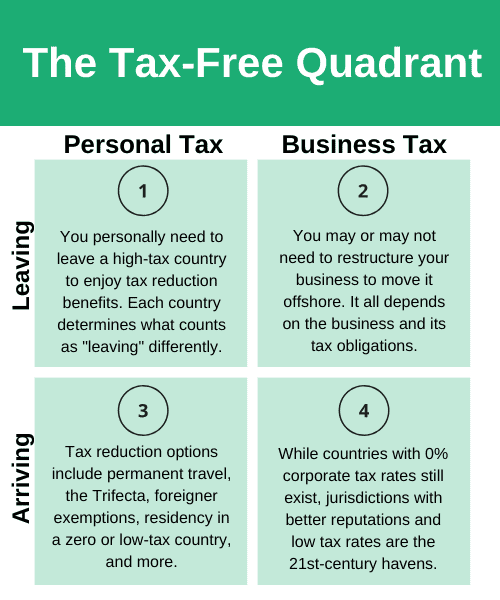

TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

A properly drafted discretionary. If you are a high-income earner it is sensible to implement tax minimisation strategies. If you are a high.

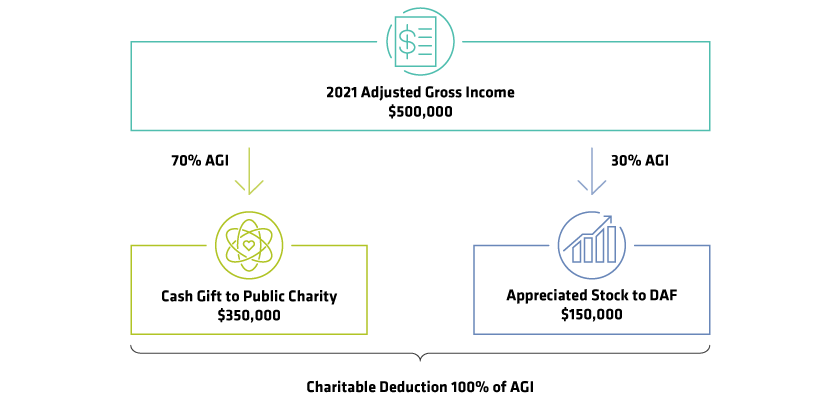

Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and. Effective tax planning with a qualified accountanttax specialist can help you to do. The higher your tax bracket the higher the benefits are of tax savings.

50 Best Ways to Reduce Taxes for High Income Earners. Tax deduction versus tax offset.

Worried About Taxes Going Up 9 Ways To Reduce Tax

How To Legally Lower Your Taxes

Tax Minimisation Strategies For High Income Earners

10 Surefire Tax Tips For Year End 2021

48 Tax Free Strategies The Roadmap To Financial Freedom With Tom Wheelwright

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Certified Tax Coach Tax Planning Strategy Tax Reduction Specialists Home Facebook

Proposal For The Latin American And Caribbean Urban And Cities Platform By Publicaciones De La Cepal Naciones Unidas Issuu

Tax Planning Income Tax Reduction Strategies For High Income Earners

Proposed Tax Changes For High Income Individuals Ey Us

5 Strategies To Reduce Investment Taxes

6 Ways To Cut Your Income Taxes After A Windfall Cbs News

Tax Planning Strategies For Your 2021 Tax Return Wipfli

Why Passive Income Beats Earned Income

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

2021 State Of Remote Work Report Payscale

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Closing The Gap In Us Retirement Savings Deloitte Insights

The Gift That Keeps On Giving Tax Breaks Renewed For 2021 Context Ab